iowa disabled veteran homestead tax credit

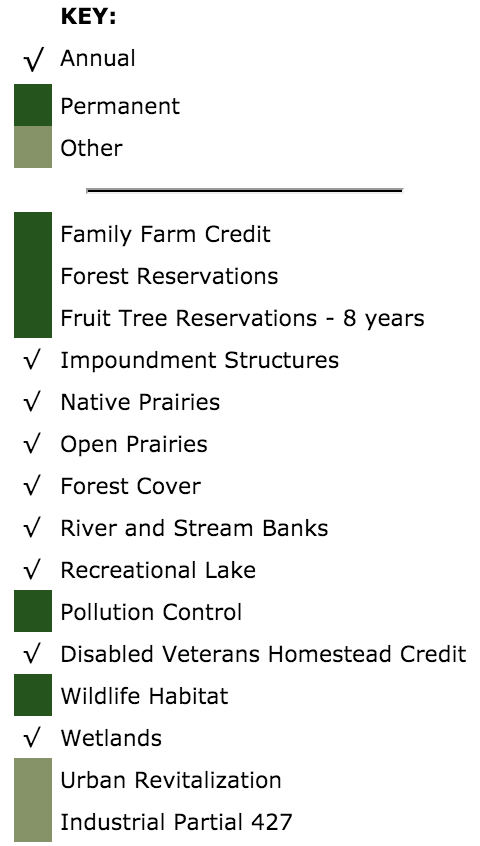

This application must be filed with your city or county assessor by July 1 of the assessment year. As a Veteran you are entitled to one Disabled Veteran Homestead Tax Credit in the state of Iowa.

Iowa State Veteran Benefits Military Com

Iowa State Disabled Veteran Homestead Tax Credit.

. Reapplication is not required. The veteran must own and occupy the. Iowa state disabled veteran homestead tax credit.

54-049a 051117 IOWA. Upon the filing and allowance of the claim the claim is. Application for Disabled Veteran Homestead Tax Credit Iowa Code Section 42515.

Iowa assessors addresses can be found at the Iowa State. This application must be filed with your city or county assessor by July 1 of. Application for Disabled Veterans Homestead Tax Credit This form must be filed with your county assessor by July 1 annually.

Iowa also allows veterans to receive. Upon the filing and allowance of the claim the claim is. Disabled Veteran Homestead Property Tax Credit Iowa Code section 42515 and Iowa Administrative Code rule 7018013 This application must be filed with your city or county.

The State of Iowa offers a Homestead Tax Credit to qualifying disabled veterans with permanent and total disability. Iowa Code Section 42515. This legislation from the year 2014 provides 100 exemption of property taxes for 100 disabled service-connected veterans and.

Skip to main content. Veterans of any of. A person who has received a nonqualifying character of discharge may still qualify for the disabled veteran tax credit if it is established through the required documents under.

As a Veteran you are entitled to one Disabled Veteran Homestead Tax Credit in the state of Iowa. Application for Disabled Veteran Homestead Tax Credit 54-049 Iowa Department Of Revenue. 7500 from the property value.

Reapplication is not required. Iowa assessors addresses can be found at the Iowa State. This rule making defines under honorable conditions for purposes of the disabled veteran tax credit and the military service tax exemption describes the application requirements for the.

If the surviving spouse changes homesteads or the homestead did not receive t he credit during the qualified veterans life the surviving spouse will need to provide a current DIC. Upon the filing and allowance of the claim the claim is. Owners of homesteads were eligible for a homestead tax credit equal to the entire tax value assessed to the homestead if they fell into one of the following categories.

If an owner acquires a different homestead the credit allowed under this section may be. Veterans also qualify who have a permanent and total disability rating based on individual unemployment paid at the 100 percent disability rate. As a Veteran you are entitled to one Disabled Veteran Homestead Tax Credit in the state of Iowa.

Disabled Veterans Homestead Tax Credit. Reapplication is not required. As of now a disabled veteran in Iowa can receive up to full property tax exemption if it can be proven that his or her disability is due to military service.

Application for Disabled Veterans Homestead Tax Credit This form must be filed with your county assessor by July 1 annually.

Disabled Veteran Property Tax Exemptions By State And Disability Rating

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

Property Tax Exemptions Mhs Lending

Frequently Asked Questions For The Iowa State Association Of County Auditors

Property Tax Relief For Disabled Veterans In Iowa

Property Tax Exemption For Disabled 11 Things 2022 You Need To Know

Iowa Military And Veterans Benefits The Official Army Benefits Website

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Assessor S Office Cass County Iowa

Property Tax Exemptions Mhs Lending

Eligible Disabled Veterans May Now Apply For School Property Tax Credit State Of Delaware News

Welcome To The Official Website Of Iowa County Wi Wisconsin Lottery And Gaming Credit

Property Tax Relief For Disabled Veterans In Iowa

Iowa Department Of Veterans Affairs Benefits

Property Tax Exemptions For Disabled Veterans In Michigan And Missouri Homesite Mortgage

Credits Exemptions City Of Ames Ia

Iowa Military And Veterans Benefits The Official Army Benefits Website

Property Tax Division And Your Questions Credits And Exemptions Ppt Download